How it works for

buyers sellers dealers

Post Ad

Search Vehicles

Sign In

Borrow $500-$50,000 to consolidate debt, cover unexpected expenses or give your budget flexibility.

Start with a loan quote to find out how much money you could qualify for – it’s quick and won’t impact your credit score.

Interested in borrowing money for a reason other than a vehicle purchase? Our trusted partner, Fairstone, offers secured and unsecured personal loans online and at 240+ branches coast to coast. With almost 100 years of Canadian lending experience, Fairstone can find an affordable loan solution that suits your needs, budget and lifestyle.

Unsecured personal loan

$5,00-$25,000

Get the money you need with manageable and affordable payments that fit your budget.

Details:

Secured personal loan

$5,000-$50,000

Use home equity to access lower interest rates, lower payments and more money.

Details:

What can you use a Fairstone Personal loan for?

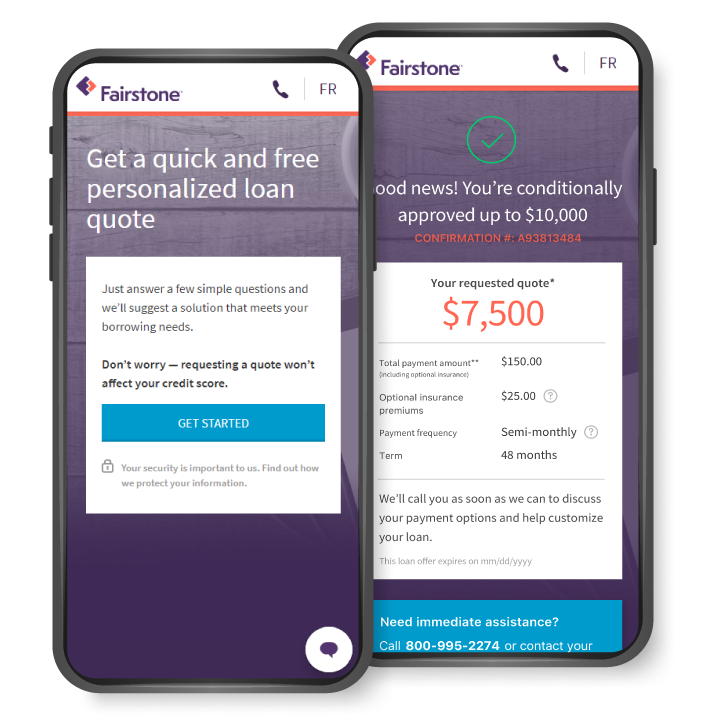

1

Get a loan quote

Enter a few simple details to find out how much money you could qualify for in minutes – no obligation, no impact to your credit score

2

Connect with a Lending Specialist

A Fairstone Lending Specialist will be in touch to customize your loan details and answer any questions you may have

3

Receive your money quickly

Finalize your loan application online or in-branch and have your money in as little as 24 hours

1

Free Loan Quote

You can get a quick, no-obligation loan quote by answering a few basic questions

2

Affordable payments

Fairstone will customize your loan and create a payment schedule that fits your needs, budget and lifestyle

3

Loans online or in branch

Fairstone offers a quick and secure loan application online or at 240+ branches across Canada

4

Personalized service

Whether you get a loan online or in branch, you’ll receive one-on-one service from a knowledgeable Lending Specialist

Compare Fairstone personal loan options to find out which one is right for you

Product |

Unsecured Personal Loan |

Secured Personal Loan |

|---|---|---|

Loan amount |

$500 - $25,000 |

$5,000 - $50,000 |

Interest Rate |

26.99% to 39.99% |

19.99% to 23.99% |

Term |

6 - 60 months |

36 - 120 months |

Secured |

No |

Yes |

Home ownership required |

No |

Yes |

Payments |

Fixed |

Fixed |

Repayment terms |

Bi-weekly, semi-monthly or monthly |

Bi-weekly, semi-monthly or monthly |

Fees |

None |

Varies by province |

Prepayment penalties |

None |

Yes |

Time to process |

< 1 day |

3+ days (varies by location) |

Guarantee |

14 days |

3 days |

|

© 2022, ™/® Fairstone Financial Inc.